That mistake is not tracking their expenses! This is extremely crucial and yet nobody likes to do it because nobody want to face the truth of where their money really went (usually goes to some avoidable lavish spending). However if you truly want to change your financial position, this is the first step to do it.

So how can you start?

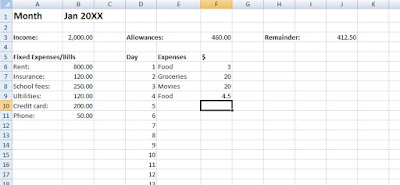

Commit yourself to track your expenses for a month. You can start by creating a spreadsheet after you got your salary, key in all the bills and fixed expenses that you need to pay and you will get a nett spending allowance.

Next, start keying in expenses you spent everyday, categorize them so you can see where majority of your money went to. Below is an example:

Of course you can customize it the way that suit your lifestyle, the main take away from this is to identify which of your expenses is taking up the largest chunk of your paycheck. While also make you spend within a limited budget.

What to do with this information?

After a month or two of doing this, you should be more cautious of where you are spending your money and you will also subconsciously not overspend your allowance. With this, you can look at how you can make leeway for extra savings that you can put away.

Example, if you find that eating out is taking up a big portion of your spending and you spend an average of $5 per eat out. You can choose to let go 2 eat out and choose to pack lunch instead, you would have save $10. So for the next month, put $10 as your fixed expenses and put the money in a separated saving account.

If you can find more ways to reduce unnecessary spending, you will start to see your saving as a "Fixed Expense" grow bigger. In no time you will have a nest egg without affecting your lifestyle too much.

No comments:

Post a Comment