For a Daddy, the greatest fear is to take care of your little ones alone. Especially when it come to getting your infants to sleep.

Let's face it, we dad do not have the luxury of breast feeding the baby to sleep and we also do not possess the gentleness that can sooth baby to sleep. So putting an infant to sleep is challenging but it doesn't mean it cannot be done.

Here is a way I find useful which I used on my 2 kids during infancy and I hope it help you have a better night rest.

Step 1: Check if the baby have a wet diaper or is hungry

First step is to eliminate anything that will wake your child up unnecessarily, that means to say change your baby diaper and feed your baby if needed.

Step 2: Create a calm sleeping environment

You can achieve this by lowering the curtain, switching off bright light and turning on your side table lamp.

Step 3: Tired your baby out

This step might seem abit cruel but if used conservatively it can be quite effective. I will allow my baby to cry it out for about 5 minutes. This will tired the baby abit to make it slightly easier to put them to sleep.

Step 4: Switch on baby videos with lullaby

This can be done concurrently with step 3. You can on baby videos with some lullaby, the purpose of this is to fixate your baby attention to a single spot.

Step 5: Proceed to hug and sway your baby to sleep

At this point your baby should be crying heavily, proceed to sooth your baby by gently swaying your baby in your arm. After awhile you will realize your baby is attracted by the video playing and will slowly stop crying.

Step 6: Put your baby down slowly

Once your baby start to become dreamy, you can slowly put your baby down and gently pat the little one to sleep with the video and music still playing. You can switch off the video once your baby is fully asleep, but I prefer to leave it on to maintain the environment.

I find this method especially useful if you combine it with pacifier, but it works fine for me both with and without pacifier.

Please note that this method may not work on all babies, so you might want to tweak the method to better suit your little one. Good Luck!

A space to share my startup journey, personal finance and parenting tips

How to start investing?

My interest in investing started when I was just 10, back then I watched a drama regarding stock broker and the things they are talking about intrigue me. The numbers, the way they try to initiate trades and all the wizard talk make them look so cool.

So I started researching on this subject when I was about 18 which is the legal for anyone to do any form of investing in my country. Now I manage my own portfolio with an not so impressive 4% per annum return and I am striving to learn more in this field to increase my return rate.

My journey as a investor did not start well as back then there wasn't much reliable information and many lesson were through trial and error. So I decided to compile the steps I take in a more chronological ways to help you get started.

1) Take Economics Class

This is the most fundamental step as most of the investment revolve around our economy. Learning economics can help you understand what is going on in the world economy so you can make a more inform decision.

I recommend studying the following:

- Supply & Demand

- Fiscal Policy vs Monetary Policy

2) Learn The Terms Used in Investing

Learning the terms used in investing allow you to communicate with your broker efficiently and it also allow you to understand what is being spoken in the mainstream media.

Example of terms in investing are as follow:

Bull - Market rising

Bear - Market falling

Blue Chip - Shares of big and reputable companies

Initial Public Offering (IPO) - New shares issue from previously private company

For more click here

3) Look at Different Type of Investment Vehicle

There are many type of investment vehicle each carrying different risk and reward. Depending on your personal risk tolerance, you might want to look at investment that is suitable for you.

Types of investment vehicle:

- Stocks

- Mutual Funds/Unit Trust

- Bonds

- Forex

- Precious Metal

- Real Estate

4) Find a Reputable Broker

After deciding on which investment vehicle is more suitable for you, it is time to find a broker. There are many broker flooding the market, it is imperative that you find a reputable one who specialize in the field of your chosen investment vehicle which will provide reliable information and good customer support. Sign up for demo account if possible to test their platform and google reviews about the broker before committing to that broker.

5) Learn About The Different Analysis Type

There are essentially 2 type of analysis:

Fundamental analysis - The study of economy, industry sector and companies to predict price movement. This is where learning about economics come in handy. It basically means reading news and annual report to make informed decision on your investment.

Technical analysis - Making informed decision through the study of past market data like price and volumes.

I find that the easiest way to learn about this 2 type of analysis is to through Forex trading. You can create a free demo account from any broker and play around with different analysis. This way you can safe guard your money while learning a valuable lesson.

Knowing all this basics should allow you to kick start your investment journey. However, no investment is 100% so it is very important that you do your due diligence and invest only with money you can spare.

To learn way to safe guard your capital, read my blog post on 3 Bucket Method to Diversify Your Savings.

So I started researching on this subject when I was about 18 which is the legal for anyone to do any form of investing in my country. Now I manage my own portfolio with an not so impressive 4% per annum return and I am striving to learn more in this field to increase my return rate.

My journey as a investor did not start well as back then there wasn't much reliable information and many lesson were through trial and error. So I decided to compile the steps I take in a more chronological ways to help you get started.

1) Take Economics Class

This is the most fundamental step as most of the investment revolve around our economy. Learning economics can help you understand what is going on in the world economy so you can make a more inform decision.

I recommend studying the following:

- Supply & Demand

- Fiscal Policy vs Monetary Policy

2) Learn The Terms Used in Investing

Learning the terms used in investing allow you to communicate with your broker efficiently and it also allow you to understand what is being spoken in the mainstream media.

Example of terms in investing are as follow:

Bull - Market rising

Bear - Market falling

Blue Chip - Shares of big and reputable companies

Initial Public Offering (IPO) - New shares issue from previously private company

For more click here

3) Look at Different Type of Investment Vehicle

There are many type of investment vehicle each carrying different risk and reward. Depending on your personal risk tolerance, you might want to look at investment that is suitable for you.

Types of investment vehicle:

- Stocks

- Mutual Funds/Unit Trust

- Bonds

- Forex

- Precious Metal

- Real Estate

4) Find a Reputable Broker

After deciding on which investment vehicle is more suitable for you, it is time to find a broker. There are many broker flooding the market, it is imperative that you find a reputable one who specialize in the field of your chosen investment vehicle which will provide reliable information and good customer support. Sign up for demo account if possible to test their platform and google reviews about the broker before committing to that broker.

5) Learn About The Different Analysis Type

There are essentially 2 type of analysis:

Fundamental analysis - The study of economy, industry sector and companies to predict price movement. This is where learning about economics come in handy. It basically means reading news and annual report to make informed decision on your investment.

Technical analysis - Making informed decision through the study of past market data like price and volumes.

I find that the easiest way to learn about this 2 type of analysis is to through Forex trading. You can create a free demo account from any broker and play around with different analysis. This way you can safe guard your money while learning a valuable lesson.

Knowing all this basics should allow you to kick start your investment journey. However, no investment is 100% so it is very important that you do your due diligence and invest only with money you can spare.

To learn way to safe guard your capital, read my blog post on 3 Bucket Method to Diversify Your Savings.

Survivor: Young Parent Guide

My journey as a young parent begin when I were 22, back then my wife is only 20 and we just got started working in the corporate world. Needless to say we weren't earning a lot and I have to think of ways to make end meet with less than $3,000 in combine income. Looking back now, I realize I made many money mistake but I manage to pull through with many help and personal sacrifice in order to feed my kids.

So I compile a list of things young parent can do to help them survive financially so you can minimize making the same money mistake I do.

Here we go~

1) Staying with your parents

I know it is tempting for young couple to want to have a place to call your own. But having a place while your kid is still in infancy will not only increase your living expenses by means of rent and utilities, you will also have to make special arrangement to take care of your child. Therefore, staying with your parent can not only minimize your living expense, they act as a caretaker for your child as well.

2) Both you and your spouse must go to work

Once you have manage to convince your parents to act as a caretaker, it is advisable that both of you go to work. Combine income from 2 person can allow you to have more money to save up for the future and working mom usually qualify for many subsidies which will be useful once your child hit toddlers age.

3) Take hand me down from others

Children grow up real fast, so buying things like clothes, toys, pram or even baby cot is not really worth the full price. So as much as possible, take hand me down from other parents whom their children have out grow. Most parent are more than happy to pass them to you, just make sure they are in good condition and safe for your child.

4) Buy only necessities

As much as possible try to buy only necessities, in the market it is fill with baby products that look good but are actually quite useless. You don't need a baby wipe warmer or an overprice blender to make baby food. So stick to the necessities and try to take hand me down or DIY to save money.

So basically, it all come down to how much you are willing to sacrifice to secure a better future for your little family. All the measure mention above are only temporary as when you grow older and your income increase, a better lifestyle will await you and your family. Good Luck.

So I compile a list of things young parent can do to help them survive financially so you can minimize making the same money mistake I do.

Here we go~

1) Staying with your parents

I know it is tempting for young couple to want to have a place to call your own. But having a place while your kid is still in infancy will not only increase your living expenses by means of rent and utilities, you will also have to make special arrangement to take care of your child. Therefore, staying with your parent can not only minimize your living expense, they act as a caretaker for your child as well.

2) Both you and your spouse must go to work

Once you have manage to convince your parents to act as a caretaker, it is advisable that both of you go to work. Combine income from 2 person can allow you to have more money to save up for the future and working mom usually qualify for many subsidies which will be useful once your child hit toddlers age.

3) Take hand me down from others

Children grow up real fast, so buying things like clothes, toys, pram or even baby cot is not really worth the full price. So as much as possible, take hand me down from other parents whom their children have out grow. Most parent are more than happy to pass them to you, just make sure they are in good condition and safe for your child.

4) Buy only necessities

As much as possible try to buy only necessities, in the market it is fill with baby products that look good but are actually quite useless. You don't need a baby wipe warmer or an overprice blender to make baby food. So stick to the necessities and try to take hand me down or DIY to save money.

So basically, it all come down to how much you are willing to sacrifice to secure a better future for your little family. All the measure mention above are only temporary as when you grow older and your income increase, a better lifestyle will await you and your family. Good Luck.

How to Correctly Price Your Product/Service?

Product/Service Pricing is one of the most critical part of your business plan, a bad pricing strategy can literally bring down your business.

When I just start up my logistic business, I make a mistake in pricing my service too low. I though I could make it if I just cover my variable cost and survive just by breaking even. Little did I know that although I am seeing growth in sales, I didn't see and growth in cashflow and it almost cause my business to fail due to insufficient cashflow.

Many entrepreneur fail to realise the hidden cost that must be factor in when it comes to their pricing strategy. And I am here to share a method that I use personally to price my services in hope that people who are starting a business will not fall into the same trap.

The key to good pricing is to know the following formula:

When I just start up my logistic business, I make a mistake in pricing my service too low. I though I could make it if I just cover my variable cost and survive just by breaking even. Little did I know that although I am seeing growth in sales, I didn't see and growth in cashflow and it almost cause my business to fail due to insufficient cashflow.

Many entrepreneur fail to realise the hidden cost that must be factor in when it comes to their pricing strategy. And I am here to share a method that I use personally to price my services in hope that people who are starting a business will not fall into the same trap.

The key to good pricing is to know the following formula:

(Img Src:http://image.slidesharecdn.com/breakevenanalysis-121110062807-phpapp02/95/break-even-analysis-3-638.jpg?cb=1352528928)

The breakeven formula allow you to consider all the cost that must be factor in and the amount of units that need to be sold at a certain price to achieve your sales target. Click here to find out more about breakeven formula.

I am not here to teach economics so I will skip the actual calculation using the formula. However, I want to highlight the important cost that must be factor in during the calculation so you can minimize risk of insufficient cashflow.

Important Cost To Take Note

1) Depreciation

If you plan to own machinery or vehicles, depreciation is major cost you must factor in so you will have enough cash reserve to replace them.

2) Your expected earnings

There is no point if your business survive but you can't feed yourself. You need to keep yourself alive to lead the business to greater heights, so factoring in your expected salary will make sure your pricing can allow your company to grow and allow you to survive.

3) 10% - 20% of cost increase

Factoring in 10% to 20% of cost increase can allow you to have pricing that need no adjustment should there be a sudden change in the economy.

Having all this cost in mind plus all the cost involve in your business, you can apply them in the formula and come out with a comfortable pricing. This method of course is not the end all and be all, you will have to adjust according to your business needs and how the market is doing.

|

Want to Save Money? Track Your Expenses!

Most people gave up saving money too soon because the feel broke after awhile and end up using their saving to fund their necessities. So they actually sabotage their own effort because they make a major mistake.

That mistake is not tracking their expenses! This is extremely crucial and yet nobody likes to do it because nobody want to face the truth of where their money really went (usually goes to some avoidable lavish spending). However if you truly want to change your financial position, this is the first step to do it.

So how can you start?

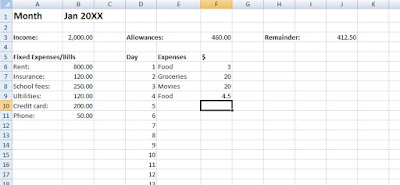

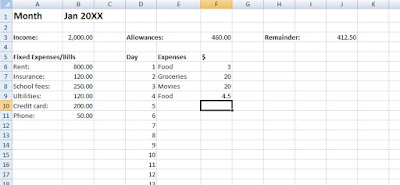

Commit yourself to track your expenses for a month. You can start by creating a spreadsheet after you got your salary, key in all the bills and fixed expenses that you need to pay and you will get a nett spending allowance.

Next, start keying in expenses you spent everyday, categorize them so you can see where majority of your money went to. Below is an example:

Of course you can customize it the way that suit your lifestyle, the main take away from this is to identify which of your expenses is taking up the largest chunk of your paycheck. While also make you spend within a limited budget.

What to do with this information?

After a month or two of doing this, you should be more cautious of where you are spending your money and you will also subconsciously not overspend your allowance. With this, you can look at how you can make leeway for extra savings that you can put away.

Example, if you find that eating out is taking up a big portion of your spending and you spend an average of $5 per eat out. You can choose to let go 2 eat out and choose to pack lunch instead, you would have save $10. So for the next month, put $10 as your fixed expenses and put the money in a separated saving account.

If you can find more ways to reduce unnecessary spending, you will start to see your saving as a "Fixed Expense" grow bigger. In no time you will have a nest egg without affecting your lifestyle too much.

That mistake is not tracking their expenses! This is extremely crucial and yet nobody likes to do it because nobody want to face the truth of where their money really went (usually goes to some avoidable lavish spending). However if you truly want to change your financial position, this is the first step to do it.

So how can you start?

Commit yourself to track your expenses for a month. You can start by creating a spreadsheet after you got your salary, key in all the bills and fixed expenses that you need to pay and you will get a nett spending allowance.

Next, start keying in expenses you spent everyday, categorize them so you can see where majority of your money went to. Below is an example:

Of course you can customize it the way that suit your lifestyle, the main take away from this is to identify which of your expenses is taking up the largest chunk of your paycheck. While also make you spend within a limited budget.

What to do with this information?

After a month or two of doing this, you should be more cautious of where you are spending your money and you will also subconsciously not overspend your allowance. With this, you can look at how you can make leeway for extra savings that you can put away.

Example, if you find that eating out is taking up a big portion of your spending and you spend an average of $5 per eat out. You can choose to let go 2 eat out and choose to pack lunch instead, you would have save $10. So for the next month, put $10 as your fixed expenses and put the money in a separated saving account.

If you can find more ways to reduce unnecessary spending, you will start to see your saving as a "Fixed Expense" grow bigger. In no time you will have a nest egg without affecting your lifestyle too much.

3 Bucket Method to Diversify Your Savings.

One of a useful method I used to reduce my risk and grow my wealth.

This method basically have you commit to spending less than you earn, split the difference and invest them in different place to reduce your investment risk.

The security bucket are investment like fixed income bond, insurance policy and your first home. This cover your basic needs so at least 60% of the money you saved up goes into here.

The growth bucket are investment like stocks and business venture where there are more fluctuation. This ensure your money grow faster, however there are more risk involve. Therefore put about 20%-30% of the money you saved here.

The dream bucket are saving for you to complete your dream. The dream bucket can be a dream home, a dream car or a dream vacation. This bucket is basically there to reinforce you to keep you motivated, if not you will have nothing but money.

The central idea is when you make money in your growth bucket, put 50% of the profit to your security and 50% to fund your dream. If your growth bucket goes bad, your security bucket is your safety net.

However, it is extremely important that you don’t take money from your security bucket to fund your growth when an opportunity arise as any unforeseen circumstances will set you back indefinitely. Or worse if you use money in the other 2 bucket to fund your dreams which create a big hole in your overall wealth.

Video Explanation: https://www.youtube.com/watch?v=JyHvNxpebIM

Subscribe to:

Posts (Atom)